5 Tax Benefits for Foreigners Setting Up a Company in Hong Kong (2025 Latest Guide)

Hong Kong is an internationally renowned financial hub known for its transparent, low-tax regime. These advantages make it a popular destination for foreigners setting up a company in Hong Kong. Through establishing a limited company in Hong Kong, international investors can legally reduce their tax burdens, especially when investing in property, stocks, and other financial assets.

In this article, we’ll outline the five key tax benefits available to foreigners who set up a company in Hong Kong and provide professional tax planning recommendations.

5 Tax Advantages for Foreigners Setting Up a Company in Hong Kong

1. Low Corporate Tax Rate and Territorial Source Principle

One major benefit for foreigners setting up a company in Hong Kong is the territorial source tax regime. Only income derived from Hong Kong is taxable, with overseas income generally exempt. Additionally, corporate tax rates are very attractive, with a maximum of 16.5% and a reduced rate of 8.25% for the first HK$2 million of profits.

2. No Capital Gains Tax on Property Investments (H3 with Focus Keyword)

Hong Kong does not impose capital gains tax. Foreigners setting up a company in Hong Kong as a limited entity can invest in property without paying taxes on capital gains from property sales. Additionally, rental income from overseas properties is usually tax-exempt.

3. Tax-Free Income from Stocks, Mutual Funds, and Dividends

Foreigners setting up a company in Hong Kong can enjoy tax-free returns from investments in stocks, mutual funds, and dividend income. The absence of capital gains and dividend taxes significantly enhances the overall investment returns.

4. Double Taxation Agreements (DTAs) to Avoid Double Taxation

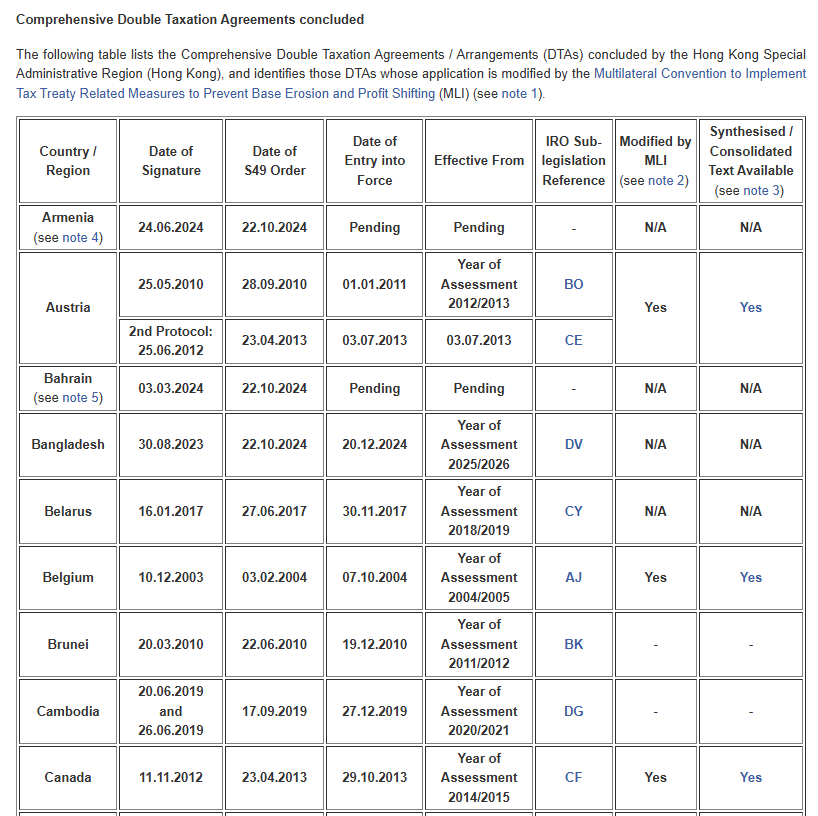

Hong Kong has signed over 40 Double Taxation Agreements (DTAs) with countries worldwide. Foreigners setting up a company in Hong Kong can effectively utilize DTAs to legally reduce or avoid double taxation on their global income.

To check which countries have DTAs with Hong Kong, please visit the Hong Kong Inland Revenue Department’s official website.

4. Legally Reduce Home Country Tax Burdens

By setting up a Hong Kong limited company, foreigners can legally mitigate high tax liabilities imposed by their home country’s global taxation system. Assets and income held through a Hong Kong entity are separated from personal taxation, thus reducing overall tax burdens.

5. No Dividend or Interest Taxation

Income from dividends and interests received by Hong Kong limited companies is generally tax-exempt, significantly increasing the net returns on investment portfolios for foreigners setting up a company in Hong Kong.

Important Considerations for Foreigners Setting Up a Company in Hong Kong

- Clearly distinguish capital investment activities to enjoy tax exemptions.

- Maintain proper documentation for tax audits and compliance requirements.

- Seek professional accounting and tax advisory services for comprehensive tax planning.

Your Reliable Partner for Foreigners Setting Up a Company in Hong Kong

We offer professional and comprehensive services tailored specifically for foreigners setting up a company in Hong Kong:

- Complete company incorporation services

- Expert tax advisory and compliance

- Efficient incorporation procedures

- Additional corporate services: secretary, virtual office, bank account opening

Ready to start? 👉 Set up your Hong Kong Limited Company now!

Recommended Internal Links:

Zero Declaration Requires Audit Report low as $3000 – 2025 Edition

Complete Guide to Incorporating a Hong Kong Limited Company

External Resources:

- Hong Kong Inland Revenue Department – Official Website

- Hong Kong Companies Registry – Company Registration Information

Frequently Asked Questions (FAQs):

Q: Do foreigners need a local Hong Kong director to incorporate a company?

A: No, Hong Kong permits 100% foreign ownership and management without local directors.

Q: How long does it take to set up a Hong Kong limited company?

A: The incorporation process usually takes approximately 5-7 working days.

Conclusion

Foreigners setting up a company in Hong Kong can legally enjoy multiple tax benefits, including low corporate taxes, exemptions on capital gains, dividends, and interests, and effective avoidance of double taxation. Leveraging these advantages through professional tax planning can significantly enhance your investment returns.

Ready to start your business in Hong Kong? Contact our professional team now for a seamless, efficient, and comprehensive company incorporation experience.